Xu Jiayin’s sturdy life: My life is up to me and not up to the sky

To become a special reader:

Click "Fried Talk" above → Menu bar in the upper right corner → Set as a star

Small stir-fry note: I lose, no one can win. – – lines from "To the Republic"

Xu Jiayin, the richest man in China from the lowest birth, and the entrepreneur with the greatest debt pressure.

In the face of the 2 trillion of Mount Tai and the embattled look down, Xu Jiayin did not lie flat, Hengda did not break the pot.

On September 23, Hengda paid the interest of 232 million yuan on the Shanghai Stock Exchange bond "20 Hengda 04" as scheduled, and its listed company Jiakai City (000918, stock bar) was transferred to Huajian Holdings; today, Hengda transferred 20% of the shares held by Dongfang Yejia to Sheng Ruishun Technology.

Xu Jiayin’s life was a life of adventure, a life of not admitting defeat, and he saved the big ups and downs in life. This time, he should think the same.

1

The first college student

Xu Jiayin’s background is not even as good as that of the young people in the small town, and he is the lowest level.

In 1958, Xu Jiayin was born in Jutaigang Village, Taikang County, Zhoukou City, Henan Province, a well-known poverty reduction area. It was not until 2019 that he took off his hat. Taikang, named after the third ruler of the Xia Dynasty, the grandson of Dayu and the son of Qi, died here, but the most famous historical figure here is Wu Guang, the hero of the grass.

When Xu Jiayin was young, his elders often told him stories about Wu Guang.

At the entrance of the village committee of Jutaigang Village, there is a conspicuous merit monument. On the front is engraved the three large characters "Xu Jiayin", as well as the inscription "Cultivate talents for the country, benefit future generations, and live forever".

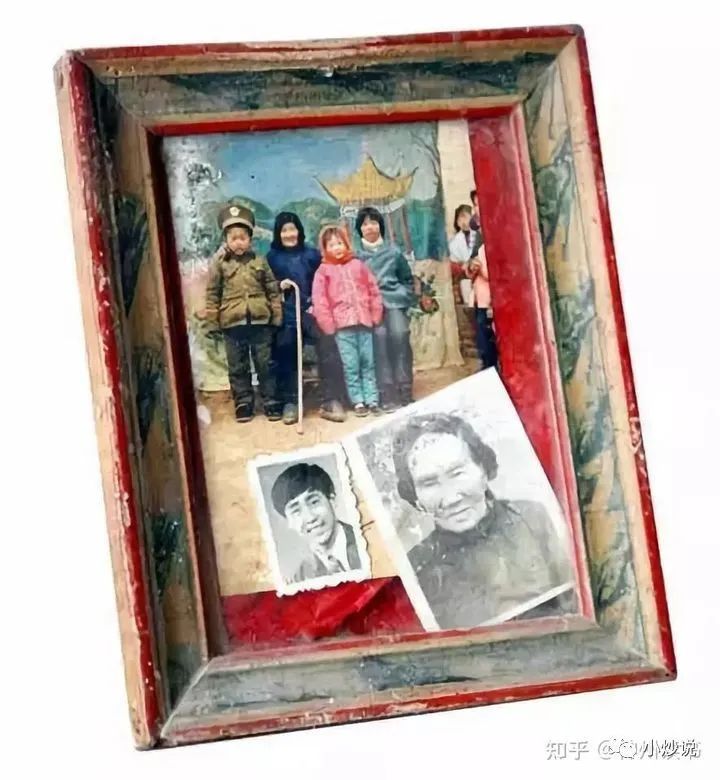

The most painful thing than being born in a poor village is losing his mother since childhood. When Xu Jiayin was 8 months old, his mother passed away due to sepsis and poverty and no money for medical treatment, and his grandmother took the role of mother.

He is a half-orphan in the countryside.

His father was an old revolutionary. He joined the army at the age of 16. After being wounded and demobilized, he couldn’t farm the land. He was planting willow trees and selling them in the market.

It can be said that Xu Jiayin grew up under the influence of business.

Xu Jiayin once described his childhood as follows:

"I finished elementary school in a windowless thatched cottage. For six years, I sat on a mud table and listened to lectures and completed homework. I slept in a big shop in high school, and each person had a bamboo basket on the wall, which was a nest all year round. This is all my food, which I can eat for a week in winter and only for three days in summer, so I still have to grow hair. But it doesn’t matter, I can still eat it after washing."

Wowotou is easy to get moldy in summer and hard in winter. In this way, Xu Jiayin often goes to school hungry.

The school and the home were in ruins. The school was made up of several thatched huts, and the desks were mud tables, which leaked air and rain. When it rained, the classroom also rained. The home was a dirt house, and a big crack had already appeared in the wall of The North Face, and the quilts and clothes were all patched.

When it comes to a difficult childhood, I find that wealthy Chinese have a different perspective than wealthy Americans.

Xu Jiayin did not shy away from his difficult childhood, but often said publicly that "this is my precious wealth", and privately liked to tell people, I was a child, and you are now dripping, how happy you are.

I have also been reading Musk’s biography recently. Musk’s childhood is also very sad. He was born in South Africa, where ethnic conflicts arose. His parents’ divorce and school bullying caused him a lot of psychological shadow. He himself avoids talking about his childhood, does not want to mention the sad past, and is very sad when he talks about it.

I prefer to believe that suffering is suffering, and who is willing to experience it? Linking suffering to wealth is quite a bit of a god’s perspective of standing and talking without back pain. This kind of funeral is happy and humorous.

When Xu Jiayin was very young, a fortune teller came to the family. After looking at it carefully, the other party said earnestly:

"Child, you are going to have a golden rice bowl in the future!"

Xu Jiayin obviously listened, otherwise he wouldn’t remember this at the age of fifty or sixty, and he would even remember the appearance of the fortune teller.

In junior high school, the school organized a trip to Taikang County, which was Xu Jiayin’s first time seeing the "city". They walked more than 20 kilometers, and there was no money for accommodation. A group of children squatted on the side of the road overnight. The huge gap between urban and rural areas made leaving the countryside the most ardent goal of young Xu Jiayin.

In 1974, at the age of 16, Xu Jiayin graduated from high school. Before the end of the "Cultural Revolution", he could not continue his studies and had to return to his hometown. Unwilling to accept the arrangement of fate, he did not want to be in the company of poverty, and he thought about how to escape from the countryside every day.

A neighbor’s family had a relative who worked at the Zhoukou Public Security Bureau. He volunteered and wrote a letter to someone asking for a job in the city, but the result was lost to the sea.

Then he tried to sell lime with a carro?a, but as a result, the car was overturned, the lime was scattered all over the ground, and the car broke down. The first business failed.

Xu Jiayin, who was afraid of whatever came, had never regarded farm work as a choice, so he had to do farm work with peace of mind. Driving a tractor, hoeing the field, digging out big dung, and doing all the work he could.

At that time, many aspiring young people like Xu Jiayin in the country were trapped in the countryside like this. Even if they had all kinds of talents, they could only lie dormant and wear them out until they were wiped out. But Xu Jiayin was always like a sniper, patiently waiting for the opportunity.

Fortunately, less than three years later, the national policy took a major turn: in 1977, China resumed the college entrance examination.

This news made Xu Jiayin ecstatic and signed up without hesitation. He dreamed of leaving the countryside and did not want to be trampled under his feet for the rest of his life. At this time, he silently said in his heart: I have waited for three years, just to wait for an opportunity. I want to fight for a breath, not to prove that I am amazing, but to tell everyone that I must get back what I have lost.

Brother Ma was headshot after saying this sentence in "The True Color of a Hero", and Xu Jiayin’s first college entrance examination failed; Brother Ma was resurrected in the second part, and the king returned. Xu Jiayin made a comeback in 1978 and became the first college student in the village with the results of Zhoukou City Flower Exploration.

At that time, Zhoukou had 10 million population, and Xu Jiayin’s achievement was enough to prove that he was a genius.

The price is that the 1.8-meter-old boy has lost more than 90 catties.

Xu chose Wuhan Iron and Steel Institute (the predecessor of Wuhan University of Science and Technology) because in the era of national steelmaking, the steel industry was like real estate and finance 10 years ago. Moreover, steel mills are generally located in cities, which means that he has a good chance of working in cities after graduation.

In 1978, Xu Jiayin took a plum blossom watch worth 100 yuan from his father and went to Wuhan. The Xu family has been single-handed down for several generations, and Xu Jiayin carries the expectations of the family.

2

Start from scratch

The gods seemed intent on playing tricks on Xu Jiayin. In 1982, Xu Jiayin graduated from college and was assigned to the Wuyang Iron and Steel Plant. The Wuyang Iron and Steel Plant is located in Wugang City, Henan Province, a small county town and only a two-hour drive from Xu Jiayin’s hometown, Taikang County.

For this result, Xu Jiayin’s heart is mixed, why did he come back after a circle?

Under the big policy of state package distribution, he had no choice but to accept the result.

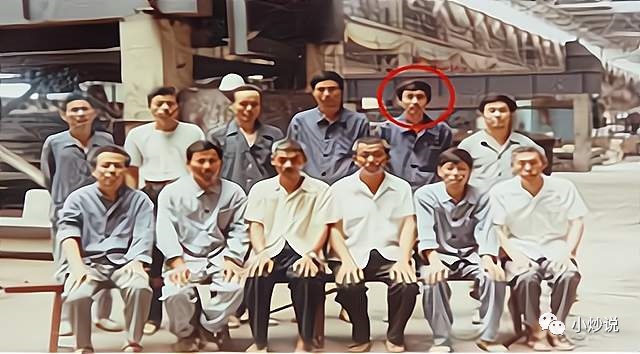

Xu Jiayin has been at Wuyang Steel for a full 10 years! I was thinking that he should have been very touched by Eason Chan’s song "Ten Years". He was the first college student here, and in order to "stand out", he volunteered to come to the laborious and dangerous front line of production: the heat treatment workshop. This choice caused quite a stir at Wuyang Steel Plant.

This is like a Tsinghua graduate student who could have been a management trainee at the headquarters of a city commercial bank, drinking tea and taking classes, but he had to go to a branch to become a corporate account manager.

Xu Jiayin was a workaholic. He thought about the workshop every day, and even went to the workshop on New Year’s Eve to have a look. In his own words, "he didn’t take a day off".

Xu Jiayin was promoted to deputy director of the workshop in the second year, and after more than a year, he was promoted to director of the workshop. Equivalent to the president of the largest branch of the bank.

The future was promising, but he served as the workshop director for seven years until he resigned.

Why can’t he be promoted? It can be seen from a small matter. Xu Jiayin, the workshop director, manages the front line of business. If he has good performance, he wants to give some benefits to the employees, such as rice, soybean oil, pots and pans. One year during the Spring Festival, he gave each employee a super gift package – 100 kilograms of rice. This time the company leader was unhappy and talked to him, saying that this kind of behavior would make other employees have ideas and did not comply with the company’s regulations.

The shackles of the enterprise system are like mountains all around Wuyang Steel, and Xu Jiayin is shackled by these mountains.

Xu Jiayin, who was disheartened, gradually had the intention to leave.

The opportunity finally appeared. In January 1992, Deng Xiaoping made a southern tour, and it became a trend to go to sea for business. At that time, 120,000 government officials went to sea, and more than 10 million people were left without pay. Now there is a group in China’s business community called the "92 faction", which are entrepreneurs who grew up in 1992.

The restless Xu Jiayin resolutely resigned, with 20,000 yuan of savings, left the familiar streets and came to the most open city – Shenzhen.

Looking back now, we feel that Xu Jiayin’s decision was natural. But for him at the time, this decision was as unusual and impressive as his choice to go to the heat treatment workshop when he first started working.

It was not easy for a poor boy to become a middle-level manager of a large state-owned enterprise, with status and status. In 1992, he was only 34 years old, which was considered young and promising.

Give up everything you have worked hard to get, go to a strange city to engage in a strange field, and you have no background. This is like a bank branch president in Henan, following the big policy of getting rid of the virtual and turning to the real, going to Hangzhou to submit a resume to find a job in artificial intelligence.

For example, a school loser finally knelt and licked after the class flower, and now his mind is hot, and he wants to break up with the class flower to chase the school flower.

Xu Jiayin himself said, "I will definitely leave if I don’t get promoted." It can only be said that the man’s ambition is in the four directions, and he can’t stop until he makes achievements.

After coming to Shenzhen, after a sea investment, three companies gave Xu Jiayin an offer. He chose a company called Zhongda because it was a trading company.

The Shenzhen Special Zone, which enjoys a unique geographical location, also enjoys a series of preferential policies, making it the most open city in mainland China at that time. Trade was undoubtedly the most promising industry at that time. Xu Jiayin came to Shenzhen to do trade, which can be said to be the right trend.

With this trade trend, Xu Jiayin played his own skills, first arrived in the company only 3 months, through the steel trade for the company earned 100,000 yuan.

Xu Jiayin worked hard in Wuyang Steel for 10 years and only saved 20,000 yuan.

This year, he was 34 years old. Compared to the 32-year-old Wang Shi, who earned his first pot of gold by selling corn in 1983 – 3 million yuan, Xu Jiayin’s achievement is indeed not worth mentioning. But Wang Shi has a good father-in-law, Xu Jiayin only has himself, and in the eyes of ordinary people, the 100,000 yuan in 92 years is already a huge sum of money.

The good start of the performance made Xu Jiayin realize that trade has great potential, and the true colors of "workaholics" are undoubtedly evident.

Behind the hard work, Xu Jiayin’s life was very difficult. He lived in the corridor of a friend’s house for three months, then moved to a small abandoned kitchen in the company, which was cramped and could not even close the door after putting down a single bed. Later, his wife, two sons, mother-in-law and father, a family of six, were all squeezed into a shared house, which was already the best accommodation for Xu Jiayin.

Xu Jiayin is indeed a struggling young man who has suffered without compromise and is not afraid of hardship.

No relationship background, all rely on personal hands to work hard, inspirational and down-to-earth.

Great people can shine anywhere, and Xu Jiayin soon became the sales backbone of Zhongda Company. In 1994, the boss of Zhongda planned to send Xu Jiayin to be the head of the Northeast Branch. In the face of a great opportunity, Xu Jiayin hesitated.

It wasn’t that he wasn’t confident, but he saw the rise of real estate in Guangzhou and wanted to enter the real estate market. Zhongda’s boss respected his decision.

This is the second time Xu Jiayin has come back again. The first time was to leave Wuyang Steel and go south to Shenzhen.

In 1994, on National Day, Xu Jiayin led five people to establish Pengda Company – a subsidiary of Zhongda – in a farmhouse in Chengzhong Village, Huangpu, Guangzhou.

Xu Jiayin and the real estate are indeed "turning into a dragon when encountering the situation", and he started a crazy performance.

His first real estate project was called "Zhudao Garden". At that time, 80% of the real estate in Guangzhou were large apartments. Xu Jiayin took a different approach and formulated a strategy of "small apartments, low prices".

Then, the symptoms of "workaholism" flared up again. He was like a clockwork machine that did not know how to stop, achieving a miracle of high turnover: from land acquisition to completion, it took only one year! Hundreds of houses in the first phase were sold out, and "Pearl Island Garden" became a hot topic of discussion.

In fact, Xu Jiayin was a real estate layman. At that time, he would suddenly ask people around him: "What does the plot ratio mean?"

The hit "Zhudao Garden" laid the foundation for Evergrande’s true colors in the future: low prices, fast construction, and high turnover. Of course, high debt is indispensable: loans to acquire land, construction parties advance funds for construction, and construction starts immediately after the end of the first phase of the second phase.

By the time of accounting in 1997, "Zhudao Garden" had achieved a net profit of 200 million yuan. Xu Jiayin is indeed a "martial arts genius" with amazing bones: the first time he did real estate, he earned 200 million!

At that time, Xu Jiayin’s salary was 3,000 yuan per month, which was a serious mismatch between his salary and his contribution. After making great contributions, he stood up and ran into the boss’s office, demanding a raise.

Unfortunately, he met the black-hearted boss. The two had a long conversation, chatting about dreams, feelings and other topics, but did not talk about salary increases. Xu Jiayin, who was woken up by a basin of cold water, scolded 10,000 "***" in his heart and resigned angrily.

Before leaving, the boss of Zhongda kindly asked him to stay, persuading "young people not to be too arrogant". Xu Jiayin threw out a sentence, "Do you still call young people if you are not arrogant?" He left Zhongda directly.

Xu Jiayin later said that if he promised to give an annual salary 100,000 or 200,000, he would not choose to start a business.

When I saw this, I felt sorry for Xu Jiayin. Because at this time, his wife, two sons, mother-in-law, and father, a family of six, were still crowded in a shared house, and he was already 39 years old, still a three-person: no house, no car, no deposit.

To use the national football team’s mantra, "you don’t have much time left".

This young man who crawled out from the bottom of society crawled all the way, "I can’t help my life" for 20 years, and finally saw a rush, and was extinguished by someone else’s urine.

It really felt like God had no eyes.

On Labor Day in 1997, a frustrated Xu Jiayin emerged from the office of Zhongda’s boss and was forced to embark on the road of entrepreneurship.

Evergrande was established in this context.

This is the third time Xu Jiayin has started all over again.

At this time, Evergrande is a late arrival in the real estate industry. Wang Shi’s Vanke entered real estate as early as 1988 and completed its listing in 1993; Yang Guoqiang’s Country Garden has gone through a five-year development process; Xu Rongmao’s Shimao Group expanded from Beijing to Shanghai.

The meeting will be late, but not absent.

3

Real estate, here I come

Evergrande means to keep getting bigger:

"Hengda people, from ancient times to the present, are constant; the growth and development of all things in heaven and earth is great."

From the day Hengda was born, Xu Jiayin was like a gourd baby, shouting "big big" to Hengda Tiantian.

When Evergrande was first established, there were only nine people. At the first meeting, Xu Jiayin shouted: "Only use the least money to get more land, and then quickly develop and sell, and quickly withdraw funds."

However, 1997 was a very bleak year for the real estate industry because of the Asian financial crisis.

But Mr. Xu insists that the difficulties in the real estate sector are temporary and will surely dawn.

Newcomers can only pick up what others have left to eat. Evergrande’s first plot of land is located in the former Guangzhou Pesticide Factory, which is a heavily polluted waste factory in the outer suburbs. No one thinks it is suitable for building a house here.

He pounced on it without hesitation and decided to replicate the "Pearl Island Garden" model here: low price, fast construction, high turnover, and high debt: loan land, construction party advances construction, and starts construction of the second phase immediately after the end of the first phase.

On June 8, 1997, Hengda’s first real estate project, Jinbi Garden, broke ground. The opening was set on the auspicious day of August 8. The first phase was priced at 2,800 yuan, sold out in half a day, and the funds were 80 million yuan. In June 1998, the second phase was launched, and the price rose to 3,500 yuan. It was still hot and sold out on the same day.

Transforming decay into magic, Hengda successfully earned the first pot of gold.

Of course, at this time, Evergrande is still just an ordinary real estate recruit, and the real estate competition in Guangzhou is extremely intense.

But at this time, the real estate industry has bid farewell to the decadence of a year ago and ushered in a thriving development boom. Xu Jiayin naturally will not miss the opportunity, boldly rush forward, and quickly seize the market in a short and smooth way.

In June 1998, Jinbi Garden Phase II just sold out, Xu Jiayin in Guangzhou’s first land auction, spent 134 million won the land in Nanzhou Road, Haizhu District.

In 1999, Hengda stood out among more than 1,600 real estate enterprises in Guangzhou, ranking among the top ten.

But at this time, some real estate companies, such as Vanke, were more conservative and worried that the crisis of the 1997 Asian financial crisis would be repeated, so they chose a more stable and restrained strategy. Xu Jiayin was just the opposite. When others looked forward and looked around, he still rushed forward firmly.

In this regard, Mr. Qin Shuo, a well-known business observer, once mentioned in "Interpreting the Evergrande Model: Xu Jiayin" Only if you dare to fight will you win ":

"What’s remarkable about Xu Jiayin is that when he saw the general trend of China’s urbanization, land finance, and housing industrialization, he thought this was a once-in-a-century super opportunity. He didn’t take it with a grain of salt, he didn’t take it with a grain of salt, he didn’t take it with a grain of salt.

Look for the situation, stop hesitating, and just do it.

In 2000, Hengda ranked sixth in Guangzhou real estate.

In 2003, it ranked first.

In 2004, Hengda ranked among the top ten real estate enterprises in China.

Sure enough, it is "turning into a dragon when encountering the wind and clouds".

In the process, Xu Jiayin transmitted his symptoms of "workaholism" to every Evergrande person, and work was like a war. Xu Jiayin himself worked almost every day until midnight, meetings until 2 or 3 in the morning were the norm, and there were few days off. When interviewing applicants, he always said:

"If you choose to enter Evergrande, you have to become a workaholic."

Evergrande’s development strategy is to sink its business. While most companies set their sights on big city centers, Evergrande has already targeted urban suburbs and weak second-tier cities.

Xu Jiayin is always one step ahead of others. In other words, his confidence in Chinese real estate is always better than others.

In June 2006, Hengda planned to go public. In 2007, Hengda’s land reserves increased by 9 times compared with 2006. In March 2008, Hengda’s land reserves reached 45.78 million square meters, the first in the country.

Behind Evergrande, more than 40 domestic real estate companies have also begun preparations for listing.

The company’s development situation and the industry situation have left Xu Jiayin with only one feeling:

It’s all good news, no bad news.

However, no one would have imagined that the 2008 financial crisis would break out.

At that time, Hengda had 37 projects under construction across the country, and only 4 projects met the standards for opening sales. Evergrande’s funding gap was 10 billion yuan!

At that time, Hengda’s total assets were only about 40 billion yuan, and its net assets were about 20 billion yuan. This funding gap was very terrifying. Hengda, which was rubbed on the ground, was definitely out of the market, and whether the company could survive was a problem.

At that time, Hengda had a large amount of land reserves and 2.80 million square meters of project pre-sale certificates, but Xu Jiayin firmly did not agree to sell land and sell projects.

"Evergrande" can only get bigger and bigger, not smaller.

In the face of domestic failure, Xu Jiayin decided to try his luck in Hong Kong and find international funds. After playing mahjong with the new world president "Shark Dare Tong" Zheng Yutong for three months, Xu Jiayin asked for $500 million in life-saving money, which is enough for Evergrande to use for a while.

Cheng Yu-tung is one of the four major families in Hong Kong, brave and adventurous, Chow Tai Fook Jewelry Store and New World Real Estate are his. It may be that he saw himself in Xu Jiayin, so he organized the game and gave 500 million US dollars: Cheng Yu-tung himself paid 150 million, Kuwait State Investment Authority 146 million, Deutsche Bank and Merrill Lynch and other five international banks 210 million US dollars, all of which were brokered by Zheng Yu-tung.

After getting the money, Hengda rushed to work at full speed. In October 2008, Hengda’s 18 real estate projects opened at the same time and sold at a discount of 25%, 11.80 billion funds.

After these two risky moves, Evergrande’s cash flow has finally continued.

However, Evergrande, which has a "serious illness", has an uncertain future, and its listing can only be put on hold.

But Zheng Yutong’s $500 million is an equity investment. If Evergrande cannot go public, these funds cannot be unwound. In October 2009, Evergrande announced that it would start listing again.

During the listing process, Cheng Yutong publicly supported Hengda, investing 50 million US dollars to subscribe for Hengda shares, the old man paid and made efforts, and several rich people in Hong Kong also gave full face to come out of the platform. Li Ka-shing invested 100 million US dollars, Emperor Yang Shoucheng invested 100 million Hong Kong dollars, and Lau Joseph-hung invested 50 million dollars.

The real money of these bosses has given investors a reassurance.

On November 5, 2009, Evergrande was listed on the Hong Kong Stock Exchange.

In contrast, the listing plans of real estate companies such as Excellent Real Estate, Fujian Mingfa, and Xiamen Yuzhou have been blocked.

It can be said that the banknote ability of Hong Kong-funded enterprises has lifted Evergrande into the stock exchange.

Money cannot be earned by one person. The more interests and big names bound, the more beneficial it is to oneself.

On the day of listing, Hengda’s market value surpassed Country Garden and became the largest private real estate company in the mainland; Xu Jiayin’s worth reached 42.20 billion yuan, surpassing Wang Chuanfu of BYD (002594, stock bar) and becoming the richest man in the mainland.

The joy of listing did not let Xu Jiayin forget that his life was hanging by a thread in 2008. He put forward a red line requirement for Evergrande: to ensure that the company’s liquidity is not less than 10 billion yuan at any time.

4

Open life

In 2011, I graduated with a bachelor’s degree. In the fall recruitment in 2010, a classmate opposite the dormitory received an offer from Evergrande, which was the only one in the college and immediately became the envy of the whole college.

In 2012, Xu Jiayin attended the two sessions in *******. A photo ** Hermès tied to his waist became popular on Weibo, and the title ** "Brother Belt" spread like wildfire. In the photo, Xu Jiayin was full ** ****** breeze and was running, which suited the fate ** Evergrande at that time.

Evergrande survived, and Xu Jiayin did not become as stable as strategic investors thought, but believed that "if you don’t die, you will be lucky" and carried out faster expansion. Drunk, he once asked his subordinates: "How can I live forever?" How can Boss Xu, who has such romantic ideas, slow down?

In 2010, Hengda Real Estate’s operating income was 45.80 billion yuan, 7 times that of 2009, and its net profit was 6 times that of 2009.

The important reason for the soaring performance is that Evergrande has entered third- and fourth-tier cities on a large scale this year.

In 2013, Hengda sales scale 108.20 billion yuan, into the 100 billion army, the project throughout the country more than 150 cities. 7 years to achieve 50 times growth, is the 100 billion housing enterprises in the fastest growing, but also into the city’s most housing enterprises.

From 2009 to 2014, Evergrande’s sales volume grew by an average of 66.8% annually, its land reserve area grew by an average of 33.5% annually, and its net profit rose by 15 times.

In this situation, major real estate companies are frantically acquiring land and expanding desperately, lest they be one step behind.

Therefore, when I graduated from graduate school in 2014, large real estate companies were still the most popular among college students. The recruitment scene was always crowded, and the submission of resumes had to be crowded.

In 2015, under the call of the "de-stocking" policy, Evergrande’s sales volume 2013.4 billion yuan, an increase of 53.1% over 2014.

The real madness was in 2016. I was working in Shanghai at the time and went home for the Spring Festival. When I came back, I found that the house prices in Shanghai had doubled! Some colleagues bought houses, but the landlord would rather compensate hundreds of thousands of liquidated damages to re-list.

That year, many people left Shanghai.

Then, second-tier cities across the country doubled. Then, third-tier cities doubled, and small counties doubled.

In 2016, Hengda’s total assets exceeded 1.30 trillion, an increase of 78.4% over 2015; sales exceeded 370 billion yuan, an increase of 85.4% over 2015. Hengda has entered 209 cities across the country, with a total of 582 projects and a total land reserve of 229 million square meters.

This is Hengda’s fastest year of development. Evergrande’s famous advertising slogan was born at this time:

"It can be Evergrande, why bother with others?"

Evergrande’s stock is rising. In less than half a year, Xu Jiayin’s worth is like sitting on a rocket, rising 200 billion, reaching 290 billion, and this 200 billion, that will chase a Ma Yun (200 billion) figure.

"Money is not printed by the state, but by Xu Jiayin" officially spread, following the joke of Wang Jianlin, the richest man last year, "Money is not omnipotent, it is Wanda’s".

In 2015-2016, real estate companies became the favorite of the capital markets. I was doing bond financing at that time. As long as it was a top 100 real estate company, it was easy to issue bonds on the stock exchange. In sharp contrast to the current bond investors shunning real estate companies.

God let it perish first, and must first let it go crazy. At the end of 2016, "Housing and not speculation" was officially proposed. At this time, Xu Jiayin was still in a state of excitement and failed to come back to his senses. Evergrande’s second-in-command Xia Haijun said:

"The scale of real estate sales in China is about 10 trillion per year, which is basically certain."

They still don’t know that an era is coming to an end.

5

reluctantly

"Housing and no speculation" has persisted for five years, without the slightest intention of relaxation, and has become a tight spell on Evergrande’s head.

In 2016, the bond market was still hot, but Evergrande’s bond coupon rate was very high. It was originally the leader in real estate, but the bond interest rate was usually much higher than that of other real estate companies. That year, a fellow broker came to my boss to promote Evergrande bonds. After the department held a meeting and discussed, the boss’s opinion was:

Evergrande’s debt is too high to understand.

2015-2016 was two years of Hengda’s bumper harvest, which also laid the foundation for today’s hidden dangers.

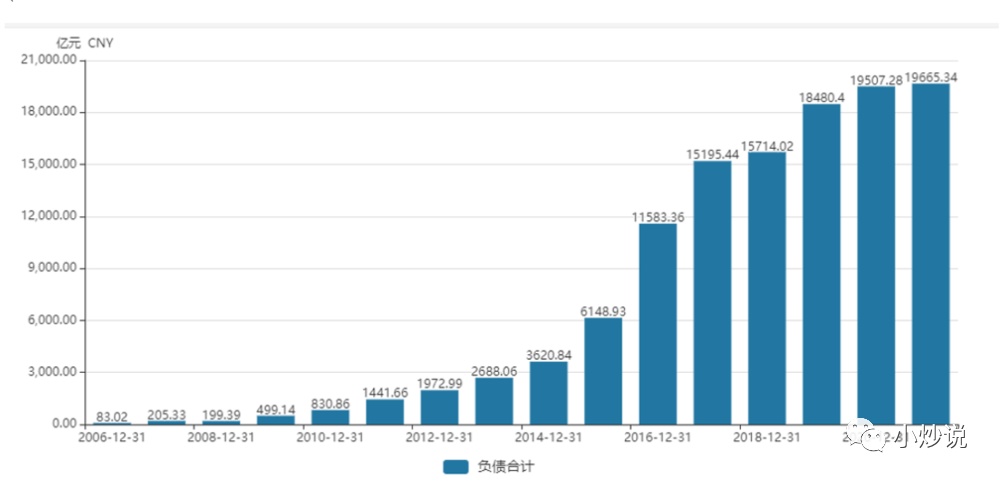

At the end of 2015, Hengda’s total debt 610 billion; at the end of 2016, the debt 1.20 trillion. That is, in 2016, the whole year, the national housing prices doubled, Hengda’s debt almost doubled, skyrocketing 600 billion.

600 billion what is the concept? In 2017, Wanda’s debt at the peak was only 600 billion, that is to say, Evergrande grew a Wanda level in one year. This is Wanda’s "money is not omnipotent, it is Wanda’s". In 2016, Shanghai’s fiscal revenue was only 640 billion.

What is the concept of 1.20 trillion debt? In 2016, the fiscal revenue of Guangdong Province 1 trillion, and Guangdong can’t afford Evergrande’s debt even if it takes the province’s power. That year, Guizhou Province’s GDP 1.18 trillion, and the debt of an enterprise is equivalent to the GDP of a province!

The skyrocketing debt has thus become a watershed for Evergrande’s fortunes.

At the performance conference held in 2017, some people have questioned Hengda’s capital chain, Xu boss replied that there is 300 billion cash on the book, if this is tight, then there is no company in the world that is not tight.

However, Boss Xu did not take the money to reduce the debt like Wang Jianlin, but took the money to continue to expand the scale. In 2017, Evergrande’s debt increased by 400 billion, reaching 1.60 trillion; in 2019, it increased to 1.85 trillion; in 2020, 2 trillion!

Times have changed, but Xu Jiayin has not changed. He still does not change the true nature of "big baby", shouting "big big" every day, and developing vigorously in suburbs and small counties. And he is no longer satisfied with the real estate field, but is involved in sports, health, tourism, automobiles and other diversified fields.

The national policy is like this. In 2017, "housing, housing, not speculation" was written into the report of the 19th National Congress of the Communist Party of China, and reducing leverage became a top priority. These two became the basic points of national financial policy since then, and more stringent policies were introduced every year.

Every policy is targeted at seven inches of real estate.

Obviously, Hengda runs counter to national policy.

In 2017, it became a turning point for Evergrande to rise and fall. Boss Xu was also reflecting in the recent meeting that if he did not diversify and stop reducing liabilities that year (2017), Evergrande would now be very rich.

When Wang Jianlin started an unprecedented fire sale in 2017, Xu Jiayin’s Evergrande was still on the run. Wang Jianlin was struggling to reduce debt, and the report "Chairperson Xu Jiayin visited Jiangsu and met with the provincial party secretary and governor to reach a consensus on further deepening cooperation and expanding investment" became famous all over the world. After a few years, Wanda’s debt has been less than 200 billion, Evergrande is 2 trillion, and the fortunes of the two richest people have parted ways.

Junbao realized the strength and softness of Tai Chi, and Tianbao walked farther and farther on the road of steel.

Looking back now, Wang Shoufu’s "Tsinghua University is not as bold as Beijing University" is a smoke bomb. Those who say it don’t believe it, but those who listen to it believe it. No wonder some people say that Wang Shoufu’s homework, how can Xu Shoufu not even copy it?

There are two ways to reduce debt: 1. Pay off the debt directly; 2. Increase capital and expand shares, and the debt will be relatively reduced. Wang Jianlin chose the first method. Xu Jiayin does not want to copy homework. You ask people who want to be famous in history to sell their core assets. This is even more difficult than the formula "35-35" of back multiplication. He did not do this in 2008 and will not do it now. His method is still the old method: listing and collecting money.

Evergrande initially wanted to backdoor listing on class A shares. In 2017, Hengda signed a restructuring agreement with Shenzhen Stock Exchange-listed company Shenzhen Shenfang: Shenzhen Shenfang will issue class A shares or cash to buy Hengda Real Estate’s shares. Hengda Real Estate backdoor back to class A shares seems to be only one step away.

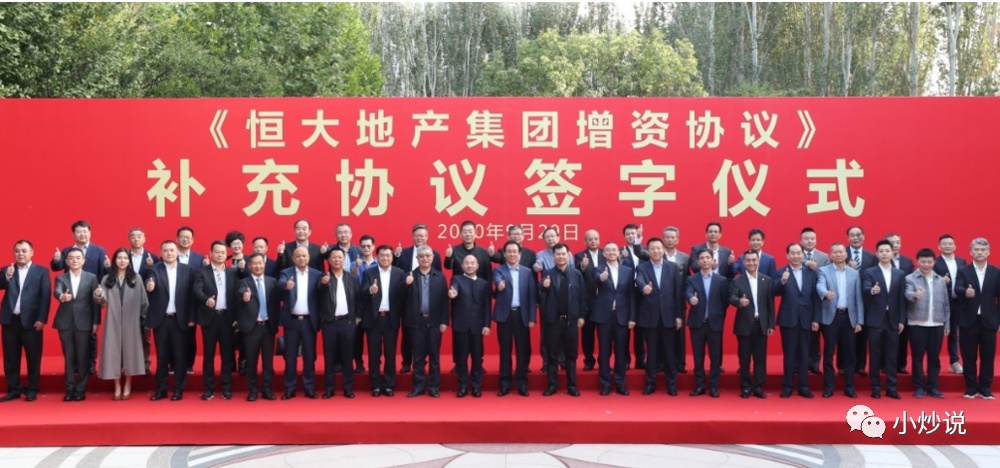

Xu Jiayin issued a "give me a clean shell, give you a powerful world 500" roar, all kinds of funds heard the wind, the original 30 billion strategic investment, directly to the 130 billion, a total of 27 investors.

This is more than $500 million in 2008.

For Evergrande, the largest real estate company in the universe, the highlight moment of 2009 is about to come again. It’s just that they still pretend not to know that this capital feast is against the trend!

After 2016, there were basically no new real estate companies listed in class A shares, and even the fixed increase was very small. R & F Real Estate prepared for the listing of class A shares in 2007, but was terminated by the Securities Supervision Commission in 2020; Wanda Commercial’s listing application was accepted in September 2015, and has been in the state of "feedback" since then.

It can be seen how strictly the regulators control this real estate leverage.

Evergrande is no exception. In 2020, a distress letter from Evergrande to the Guangdong provincial government circulated, saying that if the reorganization and listing were not carried out as scheduled, it would affect systemic risks and social stability. That tone did not seem like a request for help.

In November 2020, the restructuring of Evergrande and Shenshenfang was terminated.

As for 130 billion strategic investment, Hengda naturally has no money to repay. After a wine game, debt-to-equity swaps have taken place, holding a total of 1/3 of Hengda’s equity. To this day, it has been buried in the loess, including the 20 billion.

In 2009 and 2020, the opposite ending, the same is Xu Jiayin, the change is the general trend of the world. Xu Jiayin went to the gambling table, once defeated half of the sky, and now kneel to death in the chess game.

Xu Jiayin, who crawled out of the dead all the way, did not give up and continued to save himself.

In August 2020, the real estate intermediary platform shell was listed in the United States, and its market value once rushed to 600 billion yuan, which is the sum of the market value of Vanke and Country Garden, and more than five times the market value of Evergrande. This incident shocked the real estate industry and Xu Jiayin.

He decided to make a big news story.

Evergrande has its own intermediary platform, called RV Bao. He injected capital into RV Bao, quickly acquired the intermediary platform across the country, and threatened to integrate 30,000 offline stores. The annual transaction volume exceeds 1 trillion, and the market value will reach 2 trillion when listed.

He also wanted to bring Vanke, Country Garden, and Sunac into the company. This group of people were all ghosts, and they directly replied to Boss Xu with "you are a great man".

After tossing for more than half a year, the market value of shells has shrunk by 70%, and now it is less than 130 billion yuan. The general manager of RV Bao has resigned, and real estate brokers are asking for commissions.

Some people say that if this road is blocked, find another way. Why didn’t Xu Jiayin learn from Wang Jianlin, sell his assets, and cut his meat to save himself?

It’s not that Xu Jiayin didn’t think about it, but his obsession is too deep, from the bottom of society to sitting on a trillion empire, Hengda’s every grass and tree, he has poured his heart and soul. In terms of mentality, he would rather have the meat rotted in the pot than cheaper others. This was the case in 2008, and it will still be the case in 2020.

Just like a corrupt official who started from scratch and has no background, he would rather lie on the money and sleep, put it in the refrigerator to watch, and dare not spend it until it becomes evidence in court.

Guangdong’s central enterprises had participated in Evergrande’s negotiations and were willing to spend hundreds of billions to acquire Evergrande’s assets, but Xu Jiayin did not attend the final negotiation site, but sent the second-in-command Xia Haijun. Others understood at a glance.

And the assets he is willing to sell are all flawed, and no one else dares to take them.

Xu Jiayin, who was born a poor boy, was still too "distressed for the child" compared to Wang Jianlin, who had the rank of senior colonel’s father-in-law. Zhao Min loved Zhang Wuji and proudly shouted "I want to force it", Xu Jiayin also forced it, but Zhao Min was the princess of Ruyang King.

Therefore, in 2017-2020, Evergrande has been struggling, but a major move has failed, wasting the window of debt reduction, and the window will always be closed.

6

Don’t give up

In May 2021, I went to Taiyuan, Shanxi Province on a business trip. At the airport entrance, I saw a beautiful real estate model. I went up to chat with the marketers. He said:

Some of my friends at Shanxi Evergrande have not been paid for several months.

As early as last year, there were often people who came to me to sell Hengda tickets, as well as Sunac and Taihe, who were willing to sell them at 30% off. That is to say, for these ticket holders, they no longer expected Hengda to pay as scheduled, and they were satisfied if they were willing to pay 30% off.

In July this year, Guangfa Bank Yixing Branch sued Hengda in court, involving only 132 million amount.

Hengda’s debt crisis was finally over, and the Hengda empire was defeated like a mountain, melting rapidly like the glaciers of Greenland.

The "Hong Kong iron buddy" who saved Evergrande’s life in 2008 was helpless at this time. At that time, Cheng Yu-tung, the "leading brother", had died in 2016, and everyone else was different. Joseph Lau even reduced his holdings of Evergrande twice in August and September to cash out 116 million Hong Kong dollars.

The real estate policy in 2021 will continue to be tightened. Not only is it difficult for real estate enterprises to finance, but it is also difficult for people to buy houses. The external blood transfusion and internal hematopoiesis of enterprises both fail.

The right time, the right place and the right people, Evergrande has not a single one. "You can’t eat if you stop the cup and throw the chopsticks, and you are at a loss when you pull out your sword." It’s really "difficult to travel".

On September 21, during the Mid-Autumn Festival, Xu Jiayin wrote a letter to the panicked employees of Evergrande, convinced that "Evergrande will definitely get out of the darkest moment as soon as possible." However, it still failed to prevent Evergrande’s stock from plummeting. Evergrande is sitting on the four major Hong Kong-listed companies, with a total market value of 1.32 trillion Hong Kong dollars at one time. Now it is only 122.60 billion Hong Kong dollars, leaving only 10%. In other words, the 1.20 trillion Hong Kong dollar is in smoke.

On September 23rd, the stocks of the four major Hong Kong-listed companies in Hengda rose sharply, but they fell back on the 24th.

Market value can evaporate, but the debt won’t, it’s there intact. Even without the bottomless off-balance sheet hidden debt, Evergrande’s debt on the books has reached 2 trillion yuan.

1.40 billion Chinese, each person donates 1400 yuan to help Hengda pay off its debt.

If Evergrande’s debt is ranked in the GDP rankings of China’s provinces, Evergrande can rank 20th, second only to Guangxi and higher than Guizhou. Equivalent to two Gansu, four Hainan, and ten Tibet!

If Evergrande’s debt is included in the global GDP rankings, Evergrande can rank 40th, second only to South Africa and higher than developed countries Finland and New Zealand. For Evergrande, there is no one in Africa who can play except South Africa.

This debt level is unprecedented, and it is likely that no one will come later.

On September 23, Hengda paid the interest of 232 million yuan on the Shanghai Stock Exchange bond "20 Hengda 04" as scheduled. The day before, Hengda held a management meeting of 4,000 people overnight, and middle and senior managers cut their salaries by 40% in an all-round way. Do everything possible to "resume work, resume production and ensure delivery".

Evergrande’s final way out is to cut meat and sell assets. It’s useless to be reluctant to bear the child and not be able to trap the wolf.

Jiakai City and Dongfang Yejia are just the prelude, and there will be more asset fire sale news in the future.

7

zealous charity

In 2019, I often went to Bijie, Guizhou for business and stayed at Hongshan International Hotel. On the way from the hotel to the company, I always saw the sign "Hengda Group Bijie Poverty Alleviation Company", which was very conspicuous, just next to Bijie No. 1 Middle School. Across the road is a hotel "Tenglong Hyatt", where Hengda employees live.

Hengda has invested more than 11 billion yuan here, and Bijie’s annual fiscal revenue is only 13 billion. I used to think that the symbolic meaning would be greater than the substantive meaning, but the locals told me that the effect is very good, Hengda’s counterpart Dafang County is now developing well, and many people go there to visit.

In addition to Bijie, it also donated 7 billion poverty alleviation funds in other parts of the country. A total of 18 billion, which were funded in 2016-2020, is the period when Evergrande is prosperous and declining.

In 1998, just one year after Hengda was founded, Xu Jiayin took the opportunity of a business trip to return to his hometown in Henan. On the way, he saw a 10-year-old child playing pig grass. Xu Jiayin was very uncomfortable when he saw it. After asking, he realized that the family could not afford the annual tuition fee of 140 yuan.

Xu Jiayin couldn’t bear to listen any longer, so he immediately changed his itinerary and went to the primary school to have a look. When he saw it, his heart was cold, and his conditions were not much better than his studies back then, but there was still a loud sound of reading in the classroom.

Xu Jiayin with tears in his eyes immediately went to the township government and expressed his intention to donate 1 million to build a primary school. In 1999, a three-story teaching building that could accommodate 1,000 people was put into use.

In 1998, Hengda took out 1 million, and the difficulty is comparable to 1 billion now.

Xu Jiayin was the first college student in the village, who went from the bottom to the city, and the university was supported by state grants. Such people succeeded, and giving back to the society was largely from the heart, rather than simple show and political speculation.

In 2002, Hengda invested 100 million in Zhoukou City to build Hengda Middle School, with first-class conditions. 100 million, Hengda can be described as a blood.

2008 Wenchuan earthquake, that year because of the financial crisis, Hengda’s capital chain has been about to break, but still took out 10 million yuan donation, is the first donation of 10 million yuan in the south of the enterprise.

In the 2020 Wuhan epidemic, Hengda was blocked from listing at that time, and the pressure of debt was huge, but it donated 200 million yuan.

In July 2021, Henan flooded, when Guangfa Bank Yixing Sub-branch sued Hengda to court, Hengda debt crisis was imminent, but donated 20 million.

These are large donations from Evergrande during difficult times for the company, and countless donations at other times.

From 2012 to 2021, Xu Jiayin ranked first in the Forbes China Charity Ranking for five years, with the exception of 2015, all other years were in the top three.

Even if these are just face-saving projects, it is better to spend real money than to lose face and not pay. I sincerely hope that there will be more face-loving entrepreneurs in China.

summary

For such a company that seriously owes debts, repays money seriously, and does charity seriously, how many people want it to fail? Even if not, will God get what he wants?

In the movie "Tai Chi Zhang Sanfeng", Junbao transforms into the ancestor of Tai Chi with "hard is broken, soft is always there, soft feathers are stronger", and Tianbao’s stubbornness has seen "I finally got all this, I can’t give up" to the end.

We love Junbao in childhood, and Tianbao in adulthood, but we will eventually find that what we love in childhood is right. "My life is up to me, but I can’t help it." Although it is hot-blooded, "the flowing water does not compete for the first place, but the competition is endless."

Xu reflected at a recent meeting: "If that year [2017] had not diversified and stopped to reduce debt, Evergrande would now be very rich."

Evergrande has already started to sell its assets, just as Junbao finally realized "let go of the burden and run to a new life" after seeing the chrysalis turn into a butterfly.

– END –

All rights reserved, welcome to reprint

This article was first published on WeChat official account: Xiaoxiao said. The content of the article belongs to the author’s personal opinion and does not represent the position of Hexun.com. Investors operate accordingly, and please bear the risk.